Why Selectivity Matters for Robotic Goods-to-Person Systems

Why Selectivity Matters for Robotic Goods-to-Person Systems

Debunking the myth that Cubic Storage systems don’t have to “dig” for bins as they rely on a natural ABC slotting algorithm

Author: Christoph Buchmann, June 2nd 2023

Introduction:

Selectivity matters!

Instant access to product (bins) is critical for the operational performance of any Goods-to-Person storage & order fulfillment system. Any multi deep storage configuration naturally leads to reshuffling the bins in front (or above, in case of vertical storage), taking up precious time and valuable performance capacity.

In the past there have been claims that cubic storage systems, such as Ocado® or Autostore® do not have to “dig” frequently for bins, as the system relies on a self-generating natural ABC slotting algorithm.

However, the math doesn’t support this statement!

This white paper is intended to objectively illustrate why cubic storage systems inevitably have to dig for bins in any multi deep storage configuration, how that negatively impacts performance and explain why product (bin) selectivity in a Goods-to-Person system matters and directly influences operational throughput and system performance.

It is important to understand that there is no such thing as a “one-size-fits-all” Goods-to-Person system. Just like with cars, there is a wide variety of options built for many different applications. Many of the available Goods-to-Person technologies have their sweet-spot, depending on whether the operation is performance driven or storage driven, depending on ABC profiles, depending on the amount of replenishment storage and other operational factors that must be considered.

So, the questions you have to ask yourself are, what are my operational needs and which system is the right one for me? The devil is in the details, but in this post, by using simple mathematical examples, we will help shine some light on the topic of “bin digging” and debunk the myth of “natural ABC slotting”.

To dig or not to dig…?

Statement:

- Selectivity matters – Instant access to product is critical for performance. Why pay for extra robot performance if it doesn’t benefit your throughput and order fulfillment rate?

- Debunking the myth – Claiming that cubic storage systems like Autostore® have a natural ABC slotting algorithm. The math doesn’t support it!

-

Fact check 1.) “Eliminating the need to dig for bins”

Cubic storage systems, like Autostore®, claim that the 80/20 ABC pareto curve naturally slots their bins in the right sequence, thus almost eliminating the need to dig for bins. Let’s fact check this:

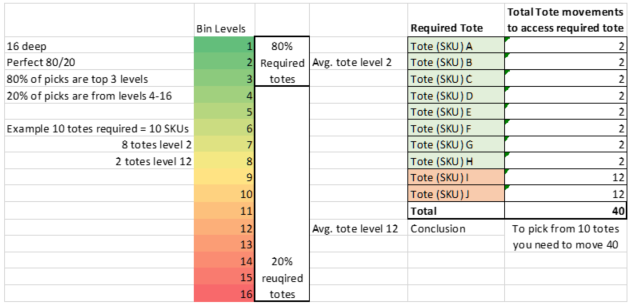

- Let us look at the math of digging out 10 required bins for picking in a 16 deep grid example based on a perfect 80/20 pareto curve:

- 10 bins required for picking = 40 bins moved

- To access the 10 bins required for picking the robots must move 40 bins in total. Ouch!

- That’s 3 bins moved to access every 1 required bin on average:

o Translated in performance, this means the system needs the additional robot performance to move 3 bins for every 1 bin it needs to pick from

o This is unproductive and a waste of money for additional robots not contributing to active picks (now add to your OPEX budget the annual fees you’ll be charged per robot!)

- Automatic storage systems with direct access to product only require 10 moves for 10 required bins

- In case of double deep storage this amounts to 12 moves for 10 required bin retrievals

The fact is, with cubic storage systems where bins are stacked vertically, you need many more robots simply to handle the:

1.) excessive digging

2.) put-away of not required bins

3.) reorganization of bins to maintain healthy ABC slotting

On 16 deep bin stacks you’re touching 4x more bins than you actually need to retrieve for picking

That’s why selectivity matters.

Fact check 2.) Cubic storage system like Autostore® have a natural ABC slotting”

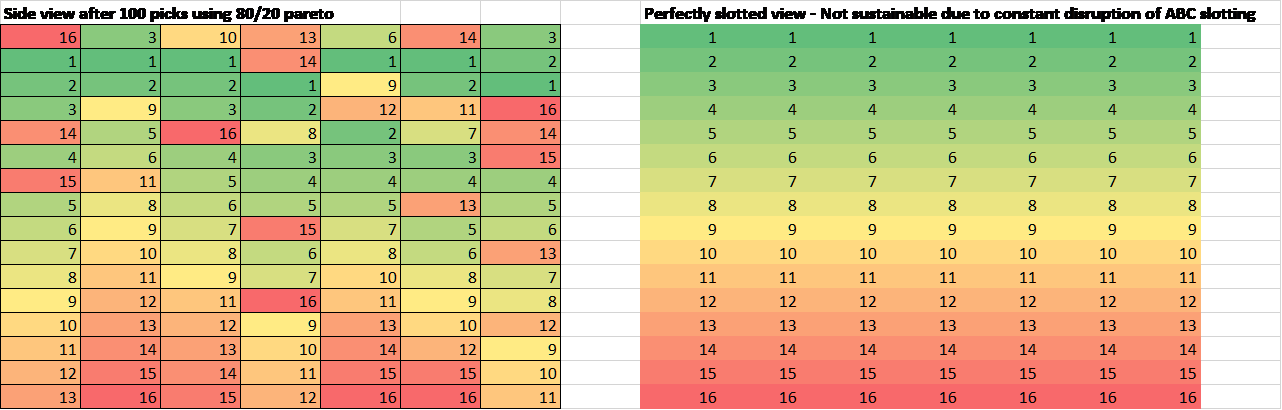

It is inevitable that slow moving SKUs will be required for order fulfillment, which consequently means the system is constantly disrupting any effort to maintain a healthy ABC balance within the stacks of bins. So, the often-presented image below of a “natural ABC slotting” doesn’t occur in reality. It’s a theoretical best-case scenario that in a live operation is not sustainable nor achievable.

It is important to understand that every time a slower moving bin (lower sitting bin) is requested, the entire “natural ABC slotting” is disrupted. And this will occur at least 2 times for every 10 Bin requested, so in other words, it’s constantly happening.

- How does bin preparation maximize throughput by Jon Schechter, VP North American Business Development

- https://www.autostoresystem.com/insights/how-does-bin-preparation-maximize-throughput

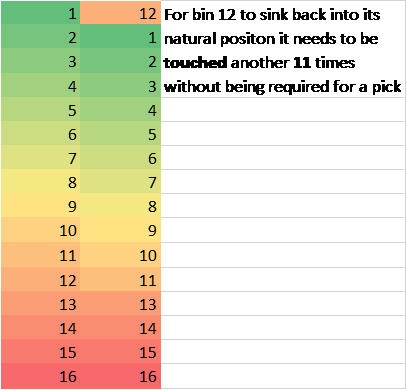

Let’s back this up with an example. In this example let’s assume Bin #12 (12th deep) was required for a pick:

- The system must touch 11 bins to access the 1 required bin #12. Bin 1-11 are put away at the next best available location, meaning on top of other stacks. They are not always put back into the original stack of bins in perfect sequence. That would be time consuming and a performance killer. While Autostore® has sophisticated software that allows for this, in reality putting bins away to the next best location is prioritized over putting bins away in the correct reverse storage sequence back into the stack they came from.

- Once bin #12 has been picked from, it will be placed back on top of a random stack of bins. Bin #12 will only “naturally” sink down to position #12 after 11 other bins have been requested again for picking. And the whole flow of excessive bin movement and natural ABC slotting disruption repeats over and over again.

- For bin #12 to sink back into its natural ABC position it will need to be touched another 11 times by robots without being required for a pick

o Note: During off-shift hours or nighttime the robots are able to reorganize bins to create a better ABC sequence for the next day operation. However, this is an unnecessary process that systems with selectivity don’t require. And a luxury that can only be used if you do not operate the night

- It is important to point out that Autostore® has sophisticated software to improve the put-away sequence of bins, but its effects are not that significant

The consequence of slow-moving bins flushing out other bins and spilling over into prime locations (top access) can been seen in this image:

*side view of grid after 100 picks using 80/20 pareto

In this example many faster moving products (bins) are now buried underneath slow-moving products and sink down to less favorable locations. That results in even more digging, since these faster moving products will be required frequently with high probability. And the disruption of the natural ABC slotting continues.

Now let’s look into the consequences or negative side effects of digging out slower moving products (bins):

- Bins that are being “flushed out” but not required for a pick temporarily block access to other bin stacks

o Some bin stacks required for new order picks are now temporarily not available as these stacks are blocked by bins being dug up and because this area is temporarily being occupied by robots putting away bins

o Putting away these non-required bins also ties up additional robot performance

- Bins are not put back in perfect order

o Usually bins that are touched or dug up but not required for picking are preferably put away in the next best location, which means on top of a new stack in close proximity

o This process speeds up the “digging” process, since the desired bin can be accessed in a reasonably short time. However, this disrupts the ABC slotting of the next stack the bin is put away at and now a slow-moving bin sits on top of a fast moving bin, and the digging begins again

- Bins can be put back in perfect sequence:

o Yes, this is a correct statement, however it drastically slows down the process since all bins need to be put back in perfect order. And the returning slow moving bin will still be put on top of another stack, adding one more digging movement once bins from that stack are required. This simply requires additional robots (maintaining any sequence is a performance killer, which is why random put-away is the preferred methodology)

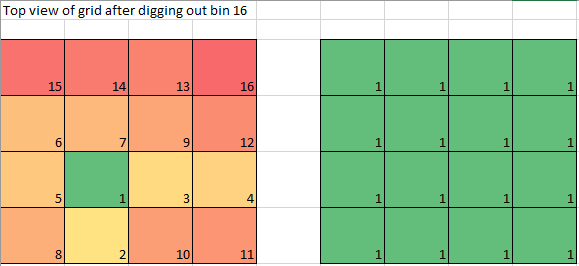

So in reality, after digging out Bin #16, this is what the top of a grid looks like vs the theoretical state of a perfect 80/20:

- Not required bins are put-away to the next best location

- Rarely are they returned in perfect order to the same stack at the right depth

This process of constantly disrupting the ABC slotting sequence is amplified the more SKUs a system has. With increasing SKU count (i.e. > 10,000 SKUs) the probability that a slow moving bin (= a lower stored bin) will be requested increases, as the absolute number of SKUs that need to be accessed at the lower levels increases. That in return inevitably creates more digging and further disrupts the ABC slotting sequence.

Operations with a high SKU count are less likely to have a favorable 80/20 pareto curve. This further contributes to the problem of excessive digging.

è Fact check 2.) There is no such thing as a “natural slotting” in cubic storage systems. The fact that the system needs to dig for bins means it’s constantly disrupting any efforts to maintain a healthy ABC slotting sequence by design

The only way to overcome this in a system like Autostore® is through constant “bin preparation” and reorganization of bins. A throughput and energy (cost) consuming process not required when you have a system that offers selectivity (instant access to product).

Inventory isn’t static, it’s highly dynamic and constantly growing and changing. Therefore selectivity matters!

Fact check 3.) “It only takes seconds to dig out a bin”

Let’s take a look at another intriguing yet practically misleading claim:

“It only takes 33 seconds to dig a bin out that sits 4 deep and less than 4 minutes to dig out the bottom bin”

Yes, while true, this is the mechanical rate to dig out a bin, in a perfect environment, if only one single bin is required. This is far from the reality of a live operation with a large number of open and fluid tasks with different urgencies and priorities.

More importantly, this is not the time required from dropping an order for a bin request to actually receiving it at the pick station for picking. It’s a misleading statement as it’s not the right metric to measure order fulfillment speed or performance. But let’s take a deeper look:

- Claim of only needing 33 seconds to dig a bin 4 levels deep (or 3+ minutes for 16 deep)

o This is a purely mechanical rate and almost irrelevant in a live operation as it’s not the time from requesting a bin to being able to pick from it at the pick station

- The right metric to measure order fulfillment performance is:

o What is the time between the WMS dropping the order on the WES to when the operator at the pick station is being presented with the required bin? Surely not 33 seconds…in reality closer to 30 minutes, at best

- Understanding statistics:

o Claiming that “in most cases 37% picks come from top level” is an extremely rare order and SKU profile which quite frankly, does not reflect most warehouse fulfillment operations

o In reality most supply chain operators would be happy to see a 70/30 ABC pareto curve. This means 70% of requested bins will come from levels 1-5 and only 6% of bins requested actually sit on the top level (6% vs 37%!!!)

è The mechanical rate to dig out a bin is an irrelevant performance metric. It does not reflect the time it takes from bin requested to bin being presented at pick station

Fact check 4.) “Cubic storage system performance is easily scalable by adding robots”

The last myth we want to look at is the claim that cubic storage systems are easily scalable in performance. Yes, but actually no…:

- Yes, you can add robots to the 2-dimensional grid of a cubic storage system

- However, you’ll quickly run into robot congestion. Robot congestion describes the situation when there is not enough space for too many robots to maneuver simultaneously

- Since the robots can only move in 2 dimensions and each robot optimally requires +/- 30 bin fields to maneuver, you will quickly reach the maximum number of robots you can deploy on the existing grid. So what now?

o Well, there you have it. Your performance is not easily scalable. In fact, it is quite limited

o You can expand the grid, which will:

§ Cost you money and downtime

§ Resulting in additional storage capacity you might not need, but you’ll be forced to accept since you need the 2-dimensional space on the top of the grid for performance reasons

è Performance is not easily scalable by adding robots, since the robot operating space is 2-deminsional and therefore quickly limited

Conclusion:

Cubic systems with their highly compact bin arrangement are great solutions for high storage capacity and low throughput. Their financial sweet-spot is almost unbeatable in this scenario.

The downside is you’ll end up paying for an excess amount of robots and unproductive performance consuming tasks that are required to compensate for the high ratio of bins touched vs bins requested. In other words, you’re paying for robots whose performance isn’t contributing to active picks and order fulfillment tasks.

The inevitable digging of bins and the continuous disruption of the “natural” ABC slotting sequence make these systems a less favorable choice for medium to high performance systems, or using data anything higher than 1,000 lines/h picked, in my opinion.

If throughput is required, you’re better off looking at the many Goods-to-Person system alternatives that offer product selectivity. That’s the key ingredient and the main purpose of this white paper.

Based on our research, cubic storage systems have their financial sweet-spot where the bins/h requested ratio vs bins stored is < 5%.

For example:

- A system with 10,000 bins and only 100 bins/h is a formidable fit for a cubic storage system (ratio of 1%)

- A system with 20,000 bins and 2,000 bins/h is not (ratio of 10%)

If you need performance, there are better solutions that offer selectivity and have a more attractive financial sweet-spot. Here are some examples that provide product selectivity and that also solve the “digging” problem cubic storage systems such as Autostore® have, but that still offer very dense and compact storage:

- Intellistore

o Bins are stacked on top of each other, but the entire stack is pushed up for another robot to access precisely the bin needed. That’s a brilliant combination of storage density and product selectivity for high performance

- e.Scala from stow Robotics:

o 66% of all bins are always instantly accessible and the other 33% only require 1 shuffle movement, thus allowing for very high performance and throughput rates

o The rack storage structure is optimized for high storage density, so you’re getting the best of both worlds

- Exotec:

o 100% selectivity as every bin is always accessible. This results into great performance

o The trade-off is the single-deep storage, impacting storage density. However, this can be off-set by the fact that the rack can be built up to 12m

- Captive shuttle systems: examples: Knapp OSR, Dematic MultiShuttle, SSI Schaefer Cuby

o These systems offer the highest performance, as they have a robot per every storage level

o They also offer good storage density as bins can be stored double and triple-deep

- NanoFulfillment, Inc. (NanoFC):

o Great solution for hyperlocal order fulfillment with fast access to products

o Redeployable, small footprint, high throughput and high storage density

So back to the original statement: Why does product selectivity matter?

- Because it directly impacts or enables system throughput, meaning a higher and faster order fulfillment performance. And that is what supply chain operations will pay for to reduce the cost per picked line

- There is an unpredictable element of forecasting which SKUs are required for the next wave of orders. That is why instant access to product matters, since it speeds up the process

- Also, the risk of product inaccessibility or system downtime is higher where products cannot be instantly accessed. A scenario no warehouse operation wants to experience

To end this white paper, and to keep it objective, let me restate that there are great advantages to cubic storage systems, such as Autostore® . They are simple, reliable, usually have a low entry price level and can be expanded over time.

The more important question is whether your operation needs performance and flexibility or high storage density, or both?

Author: Christoph Buchmann, June 2nd 2023

Disclaimer: The views expressed in this white paper are solely the opinion of the writer and are not associated with any corporate entity. This is a personal blog. Any views or opinions are presented are personal and belong solely to the author and do not represent those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated. Any views or opinions are not intended to malign any organization, company, or individual.